Hitachi’s Competitive Edge

The digitalization of our society is advancing by leaps and bounds. Digital technologies such as Big Data, AI (Artificial Intelligence), robotics, and blockchain are seeing remarkable progress, and efforts are underway to use them to create new business and service models and dramatically improve productivity.

In the financial industry, a new trend called Fintech is increasingly attracting attention, and there are growing expectations for the provision of financial services using smartphones, the development of financial and insurance products using AI, and the use of robots to improve business efficiency. While efforts to create new value include collaboration with start-ups and other industries and advanced use of data, there is a growing need to strengthen cyber security and prevent unauthorized transactions in order to deal with the risks that arise from digitalization.

Solution Concept Solution Concept

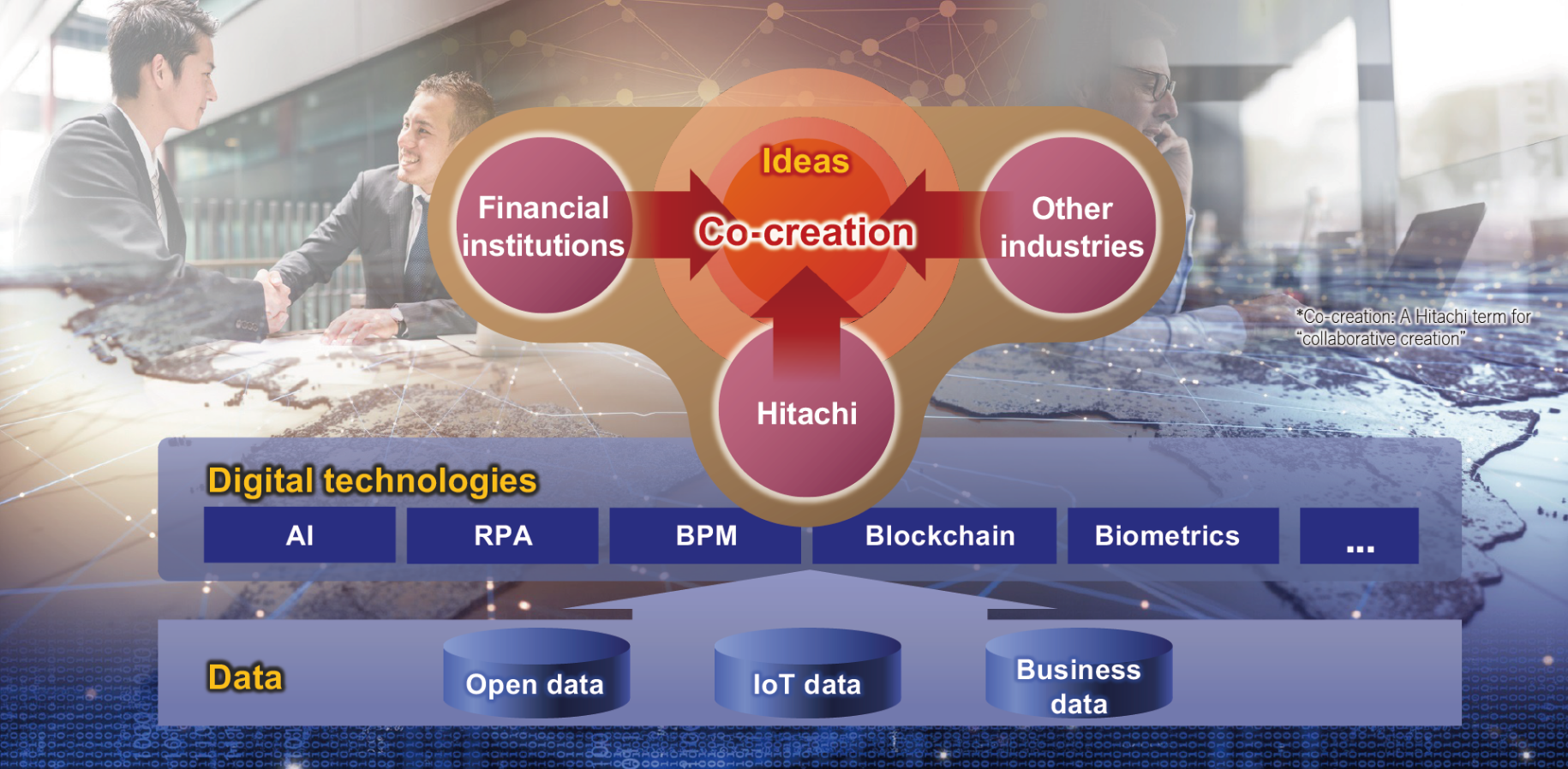

Hitachi’s financial digital solutions will utilize a wide variety of data, including business-to-business transaction data, medical big data, IoT data, and open data, as well as innovative digital technologies such as AI, blockchain, and biometric authentication technologies, to help create new financial services through collaboration among financial institutions, customers in other industries, and Hitachi’s own ideas.

Hitachi has been focusing on the financial sector as a core area of its social innovation business, and will further promote the creation of innovative financial services that meet needs in society based on its past achievements in the financial sector and the know-how it has developed in a broad range of fields.

Financial Digital Solutions Value Provided by Financial Digital Solutions

Hitachi’s financial digital solutions provides value in a variety of ways to help customers make their services more innovative. We support the rapid introduction of financial products and services to the market through the digitization of traditional IT solutions and business processes that used to be dominated by manual labor, increasing the functionality of financial services and the efficiency of administrative work, as well as improving the efficiency of business system development.

In addition, we will make significant contributions to the business growth of financial institutions through the creation of new and unprecedented services that are more accessible to financial service users and easier for everyone to use, and through collaborative creation with customers across industries and business categories.