The policy of the Company regarding dividends is to aim for stable payment of dividends while also securing funds necessary for investment, and the dividends are determined by comprehensively taking into account factors such as financial performance trends, the financial situation, and the dividend payout ratio.

The Company flexibly conducts repurchase of its shares depending on factors such as capital needs and the business environment.

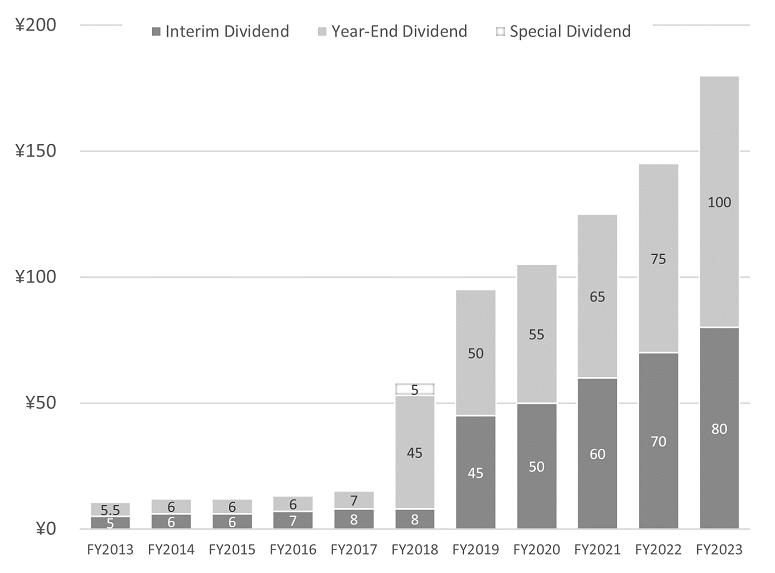

| Fiscal year | Record date | Dividend per share | Start of payment |

|---|---|---|---|

| Fiscal 2024 interim | September 30 ,2024 | ¥21.0 | November 27 ,2024 |

| Fiscal 2023 year-end | March 31 ,2024 | ¥100.0 | June 4 ,2024 |

| Fiscal 2023 interim | September 30, 2023 | ¥80.0 | November 27, 2023 |

| Fiscal 2022 year-end | March 31, 2023 | ¥75.0 | June 2, 2023 |

| Fiscal 2022 interim | September 30, 2022 | ¥70.0 | November 29, 2022 |

| Fiscal 2021 year-end | March 31, 2022 | ¥65.0 | June 2, 2022 |

| Fiscal 2021 interim | September 30, 2021 | ¥60.0 | November 29, 2021 |

| Fiscal 2020 year-end | March 31, 2021 | ¥55.0 | June 2, 2021 |

| Fiscal 2020 interim | September 30, 2020 | ¥50.0 | November 30, 2020 |

| Fiscal 2019 year-end | March 31, 2020 | ¥50.0 | June 8, 2020 |

| Fiscal 2019 interim | September 30, 2019 | ¥45.0 | November 29, 2019 |

| Fiscal 2018 year-end | March 31, 2019 | ¥50.0 (including a special dividend of ¥5.0) | May 31, 2019 |

| Fiscal 2018 interim | September 30, 2018 | ¥8.0 | November 27, 2018 |

| Fiscal 2017 year-end | March 31, 2018 | ¥8.0 | May 29, 2018 |

| Fiscal 2017 interim | September 30, 2017 | ¥7.0 | November 28, 2017 |

| Fiscal 2016 year-end | March 31, 2017 | ¥7.0 | May 29, 2017 |

| Fiscal 2016 interim | September 30, 2016 | ¥6.0 | November 28, 2016 |

| Fiscal 2015 year-end | March 31, 2016 | ¥6.0 | May 30, 2016 |

| Fiscal 2015 interim | September 30, 2015 | ¥6.0 | November 26, 2015 |

| Fiscal 2014 year-end | March 31, 2015 | ¥6.0 | June 1, 2015 |

| Fiscal 2014 interim | September 30, 2014 | ¥6.0 | November 26, 2014 |

| Period of repurchase | Method of repurchase | Total number of shares repurchased | Total purchase price for repurchased shares |

|---|---|---|---|

| September 1, 2023 to October 2, 2023 | Open market purchase | 1,938,100 shares | 19,104,201,796 yen |

| August 1, 2023 to August 31, 2023 | Open market purchase | 2,885,900 shares | 26,850,684,808 yen |

| July 1, 2023 to July 31, 2023 | Open market purchase | 2,693,400 shares | 23,913,901,919 yen |

| June 1, 2023 to June 30, 2023 | Open market purchase | 2,372,600 shares | 20,528,764,410 yen |

| April 28, 2023 to May 31, 2023 | Open market purchase | 1,183,400 shares | 9,601,865,794 yen |

| November 1, 2022 to November 30, 2022 | Open market purchase | 2,560,200 shares | 18,437,587,804 yen |

| October 1, 2022 to October 31, 2022 | Open market purchase | 6,679,200 shares | 42,968,978,715 yen |

| September 1, 2022 to September 30, 2022 | Open market purchase | 3,516,500 shares | 24,026,947,196 yen |

| August 1, 2022 to August 31, 2022 | Open market purchase | 5,197,900 shares | 35,362,958,261 yen |

| July 1, 2022 to July 31, 2022 | Open market purchase | 5,568,500 shares | 36,492,157,214 yen |

| June 1, 2022 to June 30, 2022 | Open market purchase | 4,193,800 shares | 28,147,199,111 yen |

| May 2, 2022 to May 31, 2022 | Open market purchase | 2,267,700 shares | 14,563,892,048 yen |